Corporate Governance Basic Policy

The Tsumura Group is committed to abiding by what we call the "Spirit of Nature's Laws" and fulfilling our ultimate purpose of facilitating "Lively Living for Everyone." In conducting our business, we are guided by these two tenets along with our management philosophy, expressed as "The Best of Nature and Science," and corporate mission: "To contribute to the unparalleled medical therapeutic power of the combination of Kampo medicine and Western medicine." To achieve sustainable growth and increase our corporate value over the medium to long term, our basic policy is to strengthen our corporate governance in order to ensure sound, transparent, and fair management and make prompt and sound decisions.

In June 2017, the governance structure of Tsumura changed from "company with company auditors" to "company with an audit and supervisory committee" as defined in the Companies Act of Japan. Furthermore, the Board of Directors now consists of a majority of directors from outside the Company, namely, five independent outside directors (including two audit and supervisory committee members), three internal executive directors, and one internal director who is also a full-time audit and supervisory committee member. This structure further strengthens the Board of Directors' function of supervising business execution and promotes the delegation of decision-making on certain critical business issues to assigned directors for prompt effectuation. Reporting to the Board of Directors is the Nomination and Compensation Advisory Committee (chaired by an outside director), consisting of all outside directors and the President and Representative Director. The Nomination and Compensation Advisory Committee receives a request for advice from the Board of Directors and makes proposals to it regarding the following matters: (1) supervision of the evaluation and compensation of top executives as well as determination on their nomination, reappointment, and removal; and (2) formulation and implementation of the succession plan for senior executive positions to ensure the objectivity, timeliness, and transparency of the process and the appropriateness of the nomination of successors. The Board of Directors follows the Committee's proposals to the maximum extent possible.

To enhance the effectiveness of corporate governance, we conduct an annual questionnaire survey on the effectiveness of the Board of Directors based on advice from an external evaluation organization. In evaluating the responses to each question, reviewing the activities of the Board of Directors, identifying problems, discussing improvement measures, and setting essential management themes, we engage in frank exchanges of opinion to eliminate the asymmetry of information and strengthen the surveillance of business execution.

For the Group's sustainable growth and to enhance our corporate value over the medium to long term, we will continue to advance and deepen our corporate governance.

Terukazu Kato

President, Representative Director CEO

Chapter 1 General Provisions

1. Purpose

The Tsumura Group is committed to achieving sustainable growth and enhancing corporate value over the medium to long term by applying its philosophy and vision-oriented management guided by its Purpose.* To achieve this, the Tsumura Group has established the Corporate Governance Basic Policy stating the basic concept and framework of its corporate governance and the policy on corporate governance activities. Based on this Policy, we conduct ongoing activities to enhance the transparency and fairness of our business management and fulfill our accountability to stakeholders.

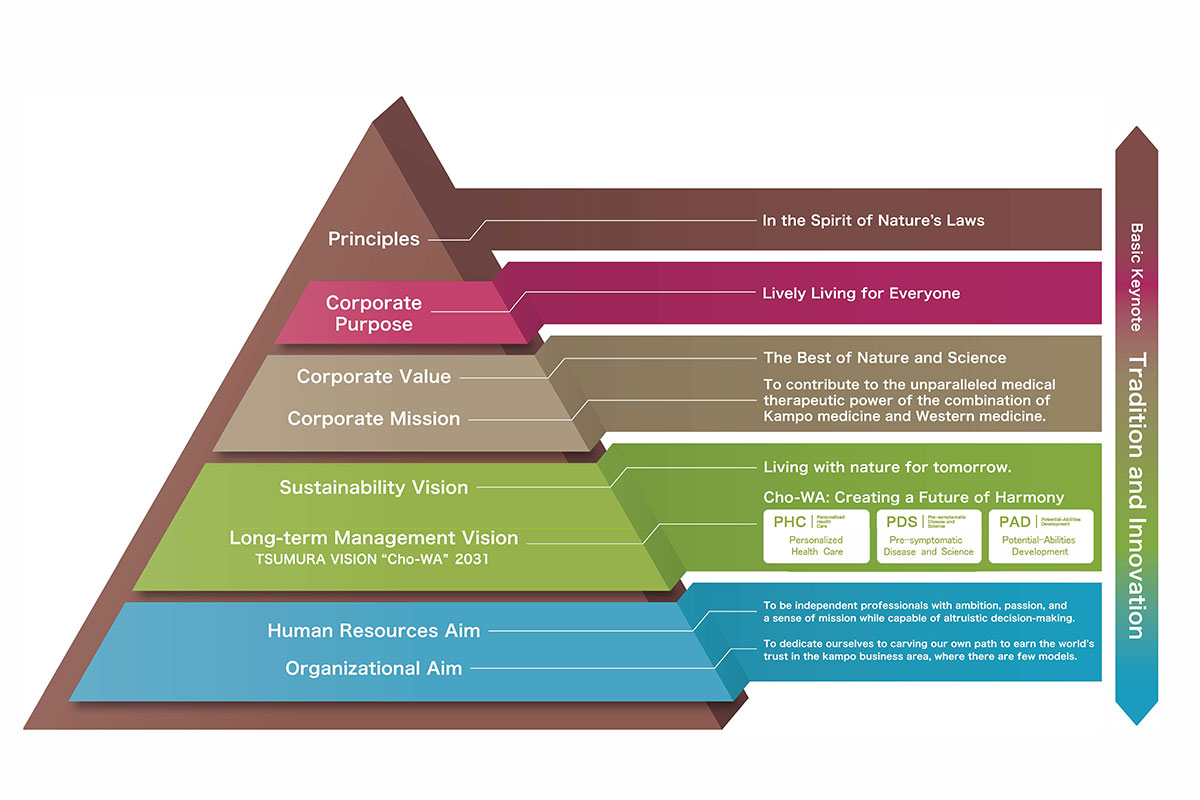

- In April 2022, we renewed our TSUMURA GROUP DNA Pyramid, placing the Spirit of Nature's Laws, Tsumura's founding principle, rule, and basis for conducting business, and Lively Living for Everyone, the Purpose of our business, at the top.

2. Basic concept of corporate governance

The Tsumura Group upholds its Principle, "Spirit of Obeying the Heavens," which are our principles in doing business, and its Corporate Purpose, "Lively Living for Everyone," which shapes our aspirations which we aim to ultimately accomplish. Guided by these, Tsumura is practicing management based on the basic principles of its corporate philosophy of "The Best of Nature and Science" and its corporate mission of "to contribute to the unparalleled medical therapeutic power of the combination of Kampo medicine and Western medicine." Tsumura's basic policy is to strengthen its corporate governance in order to realize ongoing growth and medium- to long-term increases in corporate value; ensure sound, transparent, and fair management; and to make prompt and decisive decisions.

In June 2017 Tsumura shifted from a Company with Company Auditor(s) to a Company with an Audit and Supervisory Committee to further strengthen the oversight functions of the Board of Directors. Under this system, Tsumura is working to enhance its management supervisory function and innovate its management structure by separating the supervisory function from the executive function and by appointing outside directors to comprise the majority of the Board of Directors. These measures are being implemented to continuously establish the systems that will enable the Company to ensure the transparency, improve the efficiency, and maintain the soundness of management.

3. Appropriate information disclosure

To build long-term relationships of trust with stakeholders, the Tsumura Group discloses information needed by stakeholders in a prompt, accurate, and fair manner in statutory and voluntary disclosures.

4. Establishment, revision, and abolition

The establishment, revision, or abolition of this Basic Policy shall be implemented upon the approval of the Board of Directors.

Chapter 2 Stakeholder Relations

1. Relationship with shareholders

- Ensuring shareholder rights and equalit

We disclose information promptly and proactively to ensure substantial equality for all shareholders and secure shareholder rights and their proper exercise. We maintain the Articles of Incorporation and related rules and regulations and follow appropriate procedures for the operation of shareholders' general meetings and the exercise of voting rights. - Improvement of the environment for exercising shareholder rights at the general meeting of shareholders

The general meeting of shareholders is the highest decision-making organ of the Company. Based on the principle of equality of shareholders, we make sure that all eligible shareholders can exercise their voting rights effectively. To achieve this, we have developed an electronic voting platform, we enhance the content of the general meeting notice (with a business report), we send the notice at a sufficiently early timing, and we disclose information on the website before sending the notice. - Basic capital policy

We believe that increasing corporate value through business investment for the sustainable development and growth of Kampo medicine will ultimately provide the greatest return to our shareholders and investors. We regard ROE as a critical management indicator measuring the sustainable enhancement of shareholder value. To enhance ROE, the priority issue we must tackle is improving the operating profit margin. At the same time, we will improve capital efficiency by streamlining assets, which will lead to higher ROE - Policy on strategically held shares

-

It is essential for our business to build and maintain long-term and stable relationships with our business partners. For this reason, we strategically hold shares of certain business partners in comprehensive consideration of our business relationships with them.

Strategically held shares are individually reviewed by the Board of Directors in consideration of the Company's cost of capital and, in principle, whether they will support medium- to long-term relationships with the business partners, expansion of transactions, synergies, or other business benefits. If the reason for holding specific strategically held shares no longer applies, we shall sell those shares.

We will continue the policy to sell shares of business partners that have little effect on improving our corporate value, with consideration given to the prevailing price and market conditions. We will exercise our voting rights appropriately based on how the agenda influence the enhancement of the value of the business partner and whether there are any problems with its financial condition, social contribution, or corporate governance. - If a Company shareholder that also is a business partner holding our shares for strategic purposes expresses its intention to sell or otherwise dispose of our shares, the Company will discuss the matter with the shareholder and will not prevent the shareholder from selling or otherwise disposing of the shares.

- We examine each of our strategically held shareholdings in light of the purpose of the shareholding, returns, and risk, and take appropriate actions to ensure that they do not harm the Company's interest or the common interests of other shareholders.

-

It is essential for our business to build and maintain long-term and stable relationships with our business partners. For this reason, we strategically hold shares of certain business partners in comprehensive consideration of our business relationships with them.

- Related party transactions

The Rules of the Board of Directors stipulate that transactions by directors that conflict with the Company's interests and transactions between the Company and a director must be referred and reported to the Board of Directors for deliberation. - Policy on the development of systems and activities to promote constructive dialogue with shareholders

We develop and conduct the following systems and activities to promote constructive dialogue with shareholders:- We establish and maintain a dedicated IR department.

- A representative director, the director in charge of IR, and other relevant officers conduct regular financial results briefings (quarterly).

- The dedicated IR department conducts investor briefings and facility tours and responds to media interviews.

- Questionnaire surveys of shareholders and other stakeholders are conducted by an external survey organization.

- Dialogues with shareholders are held in accordance with the Disclosure Policy

2. Relationships with stakeholders other than shareholders

- Responding to social, environmental, and other sustainability issues

Our Kampo and herbal medicine business is supported by the collaboration of all stakeholders involved in manufacturing and sales processes, starting from the growing and procuring of raw materials to quality control, manufacturing, distribution, information gathering and provision, and research and development. Recognizing various social issues in the areas of health and illness, medical care, and vitalization of the industry and the community, we have worked on these issues as Tsumura's Priority Issues to be addressed in our business activities. It is our social responsibility to address these Priority Issues and contribute to creating shared value with society and the sustainable development of society. We also strive to contribute to the achievement of the Sustainable Development Goals (SDGs) proposed by the United Nations. - Formulating and implementing a code of conduct

To fulfill its corporate mission in line with the Principles, Purpose, and Management Philosophy and contribute to solving social issues and creating a sustainable society, the Tsumura Group practices this doctrine in its business management to realize its Sustainability Vision. It has established the Sustainability Charter, the basic policy, and other relevant rules and regulations. The Compliance Committee deliberates and formulates a compliance activity policy based on annual questionnaires and incidents that have occurred inside and outside the Company. Individual departments and group companies implement compliance-promoting activities based on this policy. The compliance activity policy and the verification of the questionnaire responses are reported by the officer in charge of compliance to the Board of Directors. The Board of Directors supervises compliance activities based on the report. - Ensuring diversity

At the Tsumura Group, our people contribute to increasing our corporate value over the medium to long term and as such are valued as an essential asset. Whether new graduate or mid-career recruit, we appoint the right person to the right position based on their abilities and aptitudes, regardless of gender or nationality. Respect for diverse ways of thinking and diverse values is necessary for future global business development, developing new businesses that meet diverse market needs, and creating added value. To this end, we will actively recruit people with different types of experience, skill sets, and career pathways, and work to create a workplace environment where they can play active roles. - Group whistleblowing (internal reporting) system

The Tsumura Group maintains a whistleblowing (internal reporting) system pursuant to relevant regulations to promptly detect and correct misconduct or the risk of misconduct within the organization. The whistleblowing system consists of an internal reporting function that employees and other related people can use to report either a fact or concern regarding an illegal or inappropriate act or information disclosure without fear of disadvantageous treatment as a result. The system is properly designed to ensure that the reported information is investigated and utilized objectively. The system provides external contact points, independent of the management team, where employees can report their concerns to a lawyer or third-party organization. We also appoint persons within the Company who engage in handling whistleblowing cases. The confidentiality of the identity of reporters is protected, and it is prohibited to treat employees disadvantageously due to their having made a report. These rules and other procedures for whistleblowing are stipulated in the internal regulations and communicated to employees via the intranet and posters.

Chapter 3 Corporate Governance Structure

1. Board of Directors and Directors

-

Roles and responsibilities of the Board of Directors

The Tsumura Group upholds its Purpose and practices philosophy-guided management in which the management philosophy and corporate mission are set as basic principles and all decisions are made in reference to them.

The Board of Directors makes decisions on management strategies and plans that contribute to the sustainable growth and medium- to long-term improvement of corporate value based on constructive discussions and judgments on the appropriate level of risk-taking. Decisions regarding the execution of critical business operations are made through a comprehensive deliberation process, with consideration given to future projections, objectivity, transparency, fairness, and other factors. -

Scope of delegation to the Board of Directors

In addition to matters stipulated under law and the Articles of Incorporation, the Board of Directors makes decisions on matters requiring resolution stipulated in the Rules of the Board of Directors, such as important business plans and other basic policies as well as the acquisition and disposal of fixed assets exceeding a certain value. Decisions on matters other than those stipulated in the Rules of the Board of Directors are delegated to executive directors, executive officers, and other members of senior management. With the restructuring of the Company into "a company with an audit and supervisory committee," the scope of delegation to senior management has expanded, with certain important business execution decisions delegated to directors. The supervisory function of the Board of Directors has been further strengthened by specifying matters to be reported to the Board of Directors concerning business execution. - Term of office of directors (excluding directors who are members of the Audit and Supervisory Committee)

One (1) year - Members of the Board of Directors

In accordance with the Company's Articles of Incorporation, the Company shall have at least four (4) directors. We shall strive to optimize the size and effectiveness of the Board of Directors while securing sound corporate governance. To achieve this, independent outside directors with outstanding management abilities in their fields of specialization will comprise the majority of the Board. We will also enhance the diversity of the Board, including by appointing more female directors. - Operation of the Board of Directors and role of the chairperson

Except as otherwise provided by law, meetings of the Board of Directors will be convened and chaired by the director who is also the President of the Company in accordance with the Articles of Incorporation and the Rules of the Board of Directors.

2. Audit and Supervisory Committee and Committee Members (directors)

- Roles and duties of the Audit and Supervisory Committee

The Audit and Supervisory Committee audits the legality and appropriateness of the execution of duties by directors through the following activities: internal audit in cooperation with the Internal Auditing Department; committee members' interviews with executive officers and other senior managers about the execution of their duties; information exchange between directors of group companies and committee members; and surveillance and verification of the development and operation of internal control systems, including internal control over financial reporting. - Term of office of directors who are Audit and Supervisory Committee members

Two (2) years - Members of the Audit and Supervisory Committee

The Audit and Supervisory Committee will consist of three or more directors, a majority of whom must be outside directors.

3. Independence criteria

The Company establishes independence criteria and appoints independent outside directors who meet these criteria.

4. Appropriate audits by accounting auditors

To ensure that the external accounting auditors can conduct appropriate audits, we coordinate the audit schedule and secure the auditing system through collaboration between the Audit and Supervisory Committee, the Accounting Department, the Internal Auditing Department, and other relevant departments.

5. Nomination and Compensation Advisory Committee

- Roles and duties of the Nomination and Compensation Advisory Committee

The Nomination and Compensation Advisory Committee is established and operated in accordance with a resolution of the Board of Directors.

[Matters relating to nominations]

The Nomination and Compensation Advisory Committee examines the qualifications of nominees for directorships and executive officer positions and proposes nominations to the Board of Directors while increasing the transparency and objectivity of the election and removal of directors and executive officers and the program to develop executive candidates.

[Compensation]

The Committee deliberates on and confirms the design of the compensation system for directors and executive officers and the calculation of compensation for individual directors and officers from the perspective of transparency and objectivity and makes proposals on their compensation to the Board of Directors. - Term of office of members of the Nomination and Compensation Advisory Committee

One (1) year - Members of the Nomination and Compensation Advisory Committee

The Nomination and Compensation Advisory Committee shall consist of directors selected by the Board of Directors, a majority of whom must be outside directors. The chairperson of the Committee is selected from among members who are outside directors.

6. Effectiveness of the Board of Directors

To enhance the effectiveness of the Board of Directors, the Company conducts an Effectiveness Evaluation and Analysis of the Board of Directors every fiscal year and discloses the evaluation results. We strengthen the supervisory function of the Board of Directors to further improve the soundness and transparency of management. We also establish a system that enables prompt and sound decision-making by separating the Board of Directors from the business execution function. The Company works continuously to improve issues identified in the analysis of the Effectiveness Evaluation to enhance the effectiveness of the Board of Directors from the perspective of its supervisory and surveillance functions.

7. Training policy for directors (including Audit and Supervisory Committee members)

To ensure that directors properly fulfill their expected roles and responsibilities, the Company provides regular training opportunities to acquire the necessary knowledge, including management techniques and fostering corporate ethics.

Outside directors shall be provided with opportunities to receive explanations about the business of the departments and to visit plant facilities to promote their understanding of the pharmaceutical industry and manufacturing.

End of Document

Established October 1, 2022