CFO × Outside Director

- Looking at Tsumura’s Kampo and Traditional Chinese Medicine Businesses in Terms of Financial and Management Risk

- Commitment to Objective, Reasonable Board Discussions with Figures and Explanations

- Improving Our Initiatives by Visualizing the Relationship between Pre-Financial Capital and Corporate Value Growth

Looking at Tsumura’s Kampo and Traditional Chinese Medicine Businesses in Terms of Financial and Management Risk

Mr. Yanagi, you joined our board in June 2023. What have you learned about Tsumura’s business characteristics, particularly its financial health, compared to pharmaceutical companies focusing on new drug discovery?

Handa

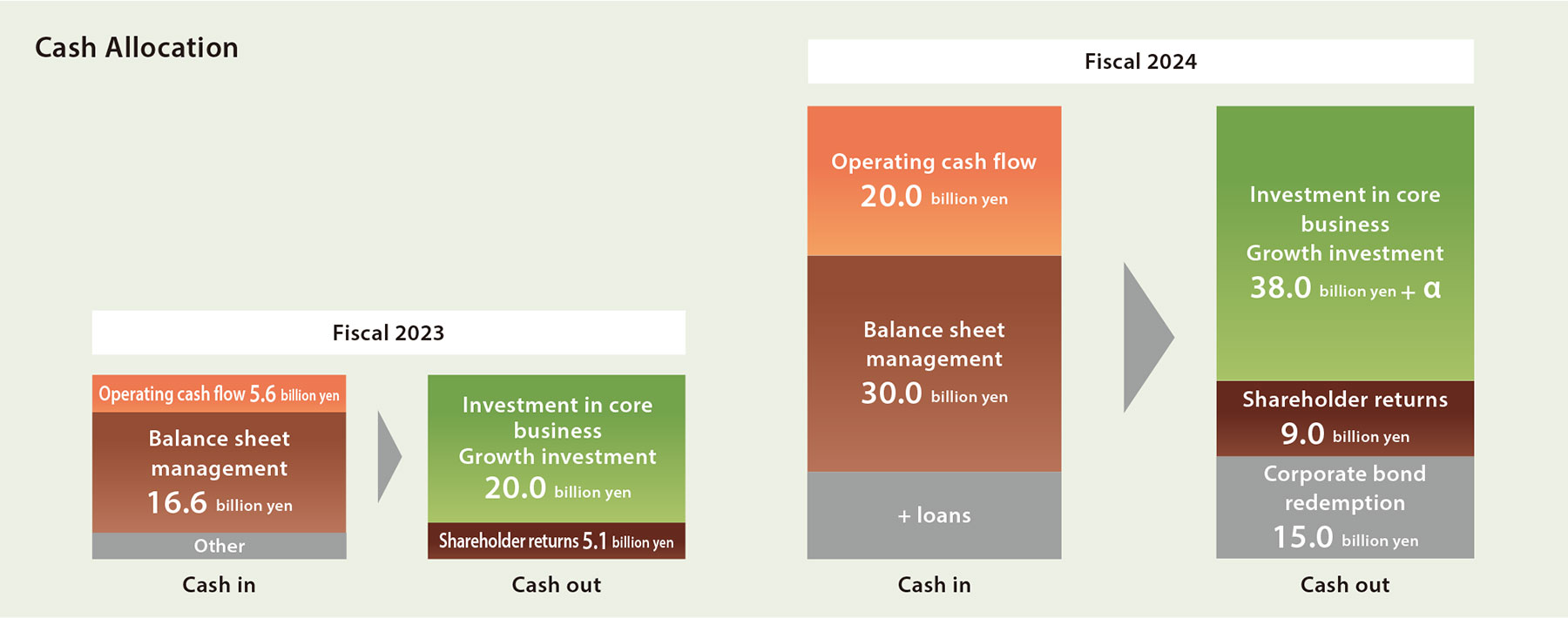

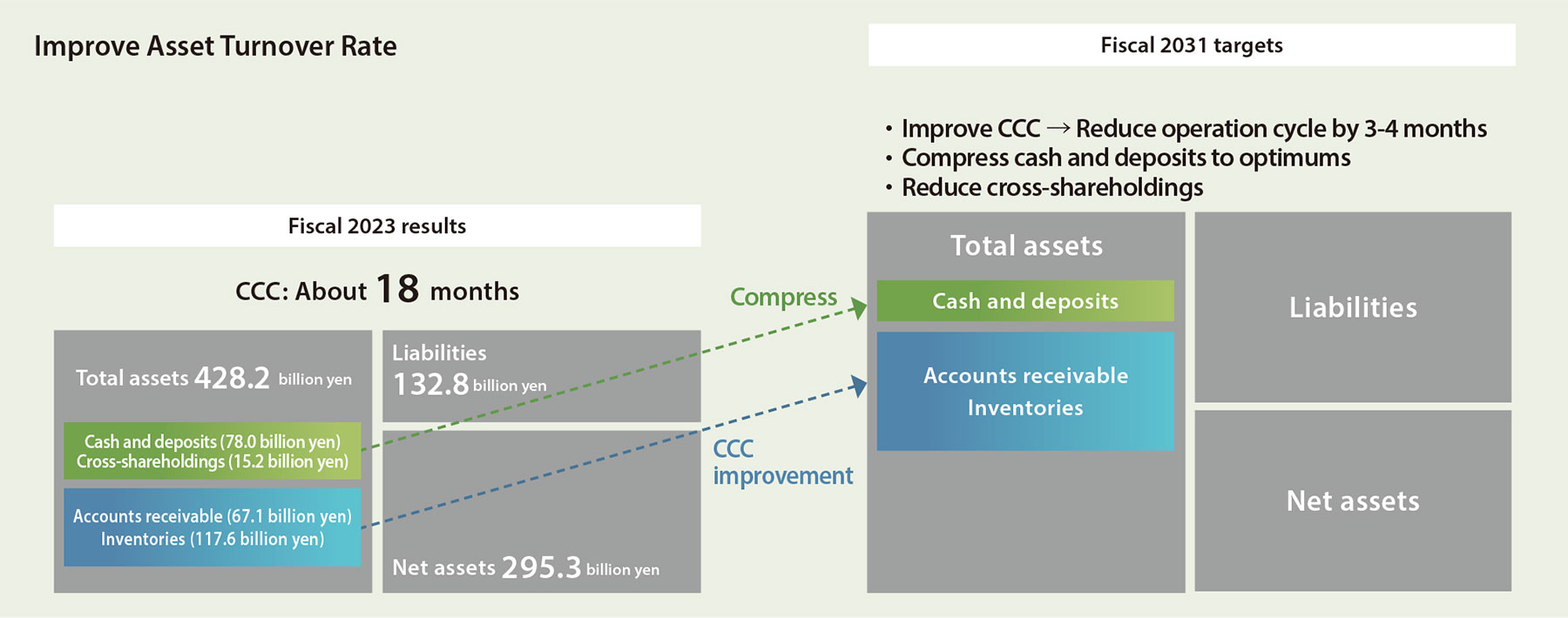

You’re right. For the sake of reliable supply, thinking strategically, we have to maintain our raw material inventories at certain levels. So high efficiency in our business operations and balance sheet management is a particularly important theme for Tsumura. While our ratio of R&D expenses is far lower than typical manufacturers of original pharmaceuticals, it’s also true that we’ve been making solid investments in basic and clinical research, mainly on high-priority themes, to help build scientific evidence, and that is generating new cash flow.

Yanagi

I work as a deputy president for the Japanese subsidiary of a British investment firm while teaching financial theory in a graduate school. This allows me to wear the hat of a foreign institutional investor. Looking at Tsumura’s balance sheet from that perspective, inventories, capital and cash seem somewhat excessive. It makes me wonder why Tsumura doesn’t reduce its equity ratio more with stronger leverage, because it doesn’t have R&D risk and enjoys over 80% of the domestic market for prescription Kampo medicines.

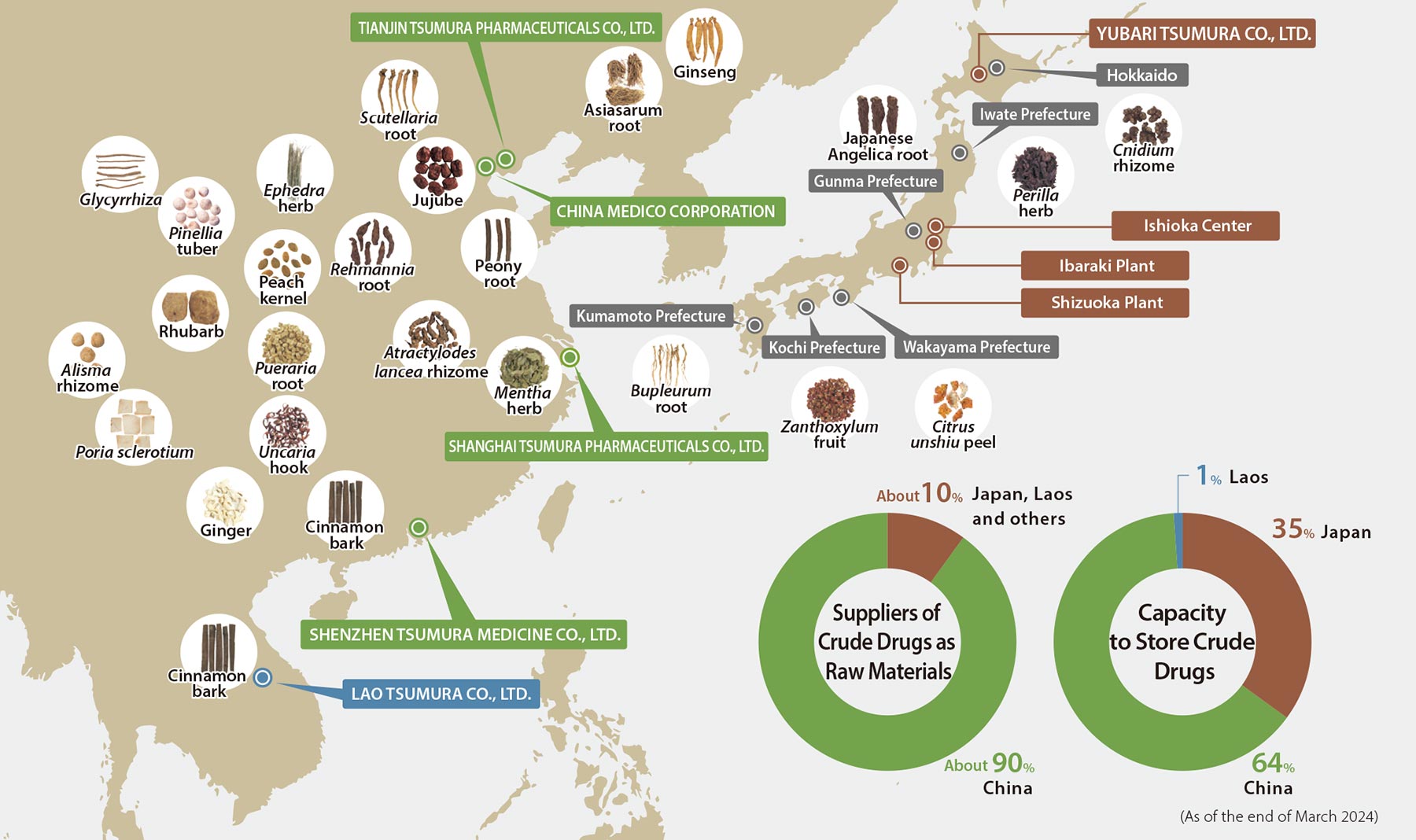

With a clearer picture of exactly what Tsumura does, it may be easier to understand why high levels of inventory and cash and a steep equity ratio are necessary as well as robust financial health. There are two background risk factors. One is an earnings structure that depends on the domestic market, under the strong influence of the NHI drug price controls. The other is high dependence on China for raw materials. I used to imagine that Tsumura could plant and harvest in countries and regions that are climatically similar to China to hedge risk.

Since I became an outside director and came to understand the volume of crude drugs that Tsumura procures and the prices it pays, and that some medicinal plants only grow in specific climates and soil types, however, it hit home for me that procuring crude drugs from China is the core of Tsumura’s business. Recently, many Japanese firms are reconsidering their Chinese operations, mainly due to rising geopolitical risk. Tsumura, on the other hand, has chosen to embrace the challenge of turning risk into opportunity, without fear.

Handa

Chinese producers are essential Tsumura partners, and together we have been mutually improving by learning from one another for over 40 years. In 2017, Tsumura committed fully to business that will contribute to public health in China.

Our motivation is to apply our original technologies and expertise to create a second core business and enhance our capacity to procure crude drugs overall.

Yanagi

That move may seem risky to the equity market, but that is outweighed by the positives of contributing to society and patients in China, which is huge in both market scale and growth potential. Tsumura’s China business currently accounts for a little over 10% of total sales. By gradually increasing this and becoming less dependent on the Japanese domestic market, and subsequently less vulnerable to NHI drug price controls, Tsumura can hedge risk.

Commitment to Objective, Reasonable Board Discussions with Figures and Explanations

Capital policy was a priority theme in board meetings in fiscal 2023. What did you discuss?

Handa

We discussed capital efficiency and optimizing our capital portfolio. I’ve been aware of the issue of cost effectiveness, thinking we have to scrutinize it to maximize effect relative to cost. Mr. Yanagi has strongly advised that board discussions be based in reasonable explanations compatible with financial rules rather than settling abstractions like “Kampo is special” or “this is for the sake of reliable supply.” Taking this shift toward more grounded discussions as an opportunity, we are reviewing our investment criteria. Over the year, I think we’ve held some very high-quality discussions.

Yanagi

That kind of appreciation is very gratifying to me as an outside director. To fulfill our fiduciary responsibilities to our shareholders, I think it’s essential to keep our discussions objective, backed by sound financial principles and figures, even though that can be annoying to some. I was asked to prove with figures the worth of value creation based on investment criteria such as NPV*1 and IRR*2, which demand capital cost consciousness. As a result, Tsumura now takes the step of checking the numbers that I’ve provided to help determine whether to go ahead with a given investment over a certain amount. I’ve been amazed at Mr. Handa’s quick action and leadership in sticking with the investment criteria. Thank you very much.

Handa

We asked Mr. Yanagi to attend board meeting followups that mostly involve people from the Corporate Planning Department discussing capital policy. In those, you’ve not only led the discussions, but have also given the attendees homework, for example, “show me your projections for the coming decade,” which highlighted the commitment of executives to an earnings structure shift. This became a good opportunity to simulate the Company’s future, bringing several risk factors into consideration. Our best takeaway from these projections has been a range of capital policies to support our future vision.

Yanagi

We’ve had numerous serious talks, and I asked the executive team to run dozens of simulations.

Handa

Through in-depth board discussions focusing on the standpoint of long-term stakeholders, we decided on ROE of 10%, equity ratio of 50% or higher and DOE*3 of 5% as new financial KPIs to achieve by fiscal 2031, and integrated the results of those discussions with our internal rules and action plans. Going forward, we will focus on incrementally executing what we decided, including improvement in our CCC*4 and reducing cross-shareholdings. As a pharmaceutical manufacturer, we have a strong commitment to quality and reliable supply, and I think we should enhance our meetings of executive officers as an organization to enable comprehensive discussion of cost effectiveness, for example.

- *1 Net present value: Difference between the values of cash inflows and outflows over a period of time; this assessment index reveals the profitability of a given investment to guide decisions on investments and M&A actions.

- *2 Internal rate of return: Discount rate balancing future cash flow generated from an investment, converted to current value, against current value of the investment. “Discount rate” means the rate applied when converting future value of a currency to current value. When the IRR is above capital cost, we proceed with the investment; when it’s lower, we discard it.

- *3 Dividend on equity

- *4 Cash conversion cycle: Number of days needed to collect sales proceeds after paying down accounts payable

Improving Our Initiatives by Visualizing the Relationship between Pre-Financial Capital and Corporate Value Growth

Tsumura’s current*5 price-to-book ratio has increased to nearly 1.2, but remains below the prime market average of 1.4. What prospects do you see for effort to build corporate value?

Yanagi

Our corporate value has been increasing due to the effects of rising earning power and new capital policies—our permanent growth rate*6 as indicated by PER is 0 or slightly negative. This means that many institutional investors are still unconvinced about the potential of Kampo and traditional Chinese medicines and Tsumura’s growth scenario. Conversely, however, Tsumura is a corporation with ample potential for growth. Our businesses are going well, with operating profit above 10% and ROE is projected at 10% for fiscal 2024. When hope grows for higher longer-term growth, our PBR should surpass 1.4, and could even approach 2. The key to winning the trust of institutional investors is steadfastly showing good results and convincing them of Tsumura’s potential for corporate value growth.

Handa

In fiscal 2023, we began a project*7 to visualize our pre-financial capital. Behind this is our resolve to explain clearly that pre-financial capital can convert to future financial capital. We made our entire ESG effort a subject for analysis using the Yanagi model*8.

Yanagi

The Yanagi model is based on the hypothesis that ESG value will be factored into a PBR above 1. In the investor survey I conducted, I found that about 70% of investors worldwide supported the idea that ESG value should be included in PBR over the long term, which agrees with the hypothesis. To show the degree of potential a given corporation has to increase its value, it will be ever more important to visualize pre-financial capital as numbers and explain them.

Handa

At Tsumura, we’ve conducted a value relevance analysis, limiting the focus to organizational and personnel capital this time. Some ESG items showed striking correlation with value, and others didn’t as much. In fiscal 2022, we began using ROIC as an index for internal management, believing that we can uncover the meaning and results of a given job and raise employee morale if we successfully identify KPIs that will help improve ROIC and explain balance sheet management step by step. We will continue improving our rules and assessment framework for resource allocation to help institutional investors understand and more accurately assess the value of the Tsumura Group.

- *5 As of June 27, 2024

- *6 A way to calculate continuous value, assuming that free cash flow will grow at a specific rate after the business plan period

- *7 See page 37 for details.

- *8 A model developed by Ryohei Yanagi, introduced in his book CFO Policy (Chuo Keizaisha, 2020)

Yanagi

First, Tsumura shares a common mission with pharmaceutical companies, to protect the lives and health of patients and consumers, staying close to each. Although ours is different in terms of the products and business model we’ve chosen to accomplish this mission, it’s essentially the same, I think. As a former financial director of a pharmaceutical manufacturer producing original products, well acquainted with its profit-loss structure, I think Tsumura’s profit-loss structure stands out for its relatively low ratio of R&D expenses and high costs. Cost growth is inevitable because prices for some crude drugs are rising right now on top of the weakening yen. We also have to maintain inventories at certain levels to manage the production volume of crude drugs, which fluctuate widely due to factors like weather.