Message from the Group CFO

Better Information-Broadcasting and Investment Efficiency: Focus of Financial Strategy

I took office as CFO in April 2025. I had previously been working for financial institutions, planning and drawing up strategies in broad fields, mainly for public corporations and those related to capital markets, and did lots of out-facing work as well. Shortly before joining Tsumura, I was an executive officer of a securities house in charge of planning related to investment banking. With knowledge and over 20 years of experience in corporate finance, I’d like to help the Tsumura Group make sustainable growth from the financial side.

I have long been strongly interested in the Tsumura Group as a philosophy-driven company, and impressed with how it carries forward the principle of its founder, “In the Spirit of Nature’s Laws,” from over 130 years ago, pursuing the Purpose of “Lively Living for Everyone” and encouraging a sense of ownership among all employees. I understand my expected responsibility as CFO is to formulate a financial strategy to achieve growth based on this philosophy while making the most of the healthy ambitions of excellent employees and building and maximizing corporate value every year.

After the announcement of our second medium-term management plan in May 2025, I talked with shareholders and investors and realized there are two factors in our financial strategy that need improvement. First is information- broadcasting regarding our businesses and equity stories we want to be better understood. Our business model as a Kampo medicine manufacturer differs greatly from those of other pharmaceutical companies, and I think that makes many aspects of our business difficult for investors to understand. So I put extra effort into open, easy-to-understand information- broadcasting, including using tools such as our integrated reports, about the unique characteristics of our businesses and growth strategy.

The second area needing improvement is investment efficiency and cost structure. I don’t see any waste in expenses, but I can’t say we have a system demanding that floor workers maximize their performance at minimum cost. In this regard, there is ample room for improvement, including raising employee awareness of investment efficiency.

Based on that understanding of our issues, my first action as CFO was one-on-one talks with floor employees. After that, I integrated ideas incorporating the return on invested capital (ROIC) tree into our internal rules and work processes to allow continuous improvement. While Tsumura’s management- control indicators already included ROIC, it was hard to see the relationship between ROIC and each business operation and the strength of its effects. So, I will work to help visualize these. To improve ROIC, it’s also crucially important that our employees are well aware of it and, based on that knowledge, set goals for their respective jobs. In this way, I think employees will feel that their daily efforts to achieve their goals will improve ROIC for the entire Group, building a beneficial cycle.

Financial Management Focused on Balancing Financial Health and Capital Efficiency

Tsumura has held over 80% of the domestic prescription Kampo formulations market for the past two decades, and our topline growth is stable. We are not subject to the risk of sales losses due to changes in the market environment or competitor situations, and expansion of the Kampo market leads directly to scale expansion for our sales. I see this as a significant advantage from a financial standpoint.

At the same time, we have three constraints to consider as we build our financial strategy.

First is the risk of price fluctuations for raw material crude drugs, about 90% of which are imported from China and susceptible to bad weather, poor crops, and fluctuations in exchange rates. Prices for prescription Kampo formulations in Japan are fixed by the National Health Insurance system, so any fluctuation in input prices has a direct structural effect on our profits. Tsumura manages input production from the cultivation stage to better ensure stable procurement and minimize price fluctuations, but that cannot eliminate this kind of risk.

Second, our inventory turnover is long and costly because of the need to hold sizable inventories of raw materials given the nature of the natural ingredients, which can be qualitatively uneven depending on the length of the growing season and weather, and there is the further risk of production impairment. To fulfill our responsibility to our healthcare organization customers, maintaining ample inventories is a must.

Last is the generally longer-than-desired time from making the decision to invest in new production equipment to recouping that investment from operations, including necessary testing periods before starting pharmaceutical production.

Due to such constraints, the prescription Kampo formulation business must maintain substantial capital to stay financially healthy. I manage the Company’s finances to maintain resilient financial health, with careful attention to its balance with capital efficiency.

Tsumura’s R&D cost is about 5% of sales, lower than the pharmaceutical industry average. Still, our research results, including building evidence for efficacy, have helped increase the number of physicians who regularly prescribe Kampo drugs. I think investment in basic and clinical research with a focus on high-priority domains, as well as in R&D projects leading directly to personalized treatments and scientific clarification of pre-symptomatic diseases, is essential for generating cash flow.

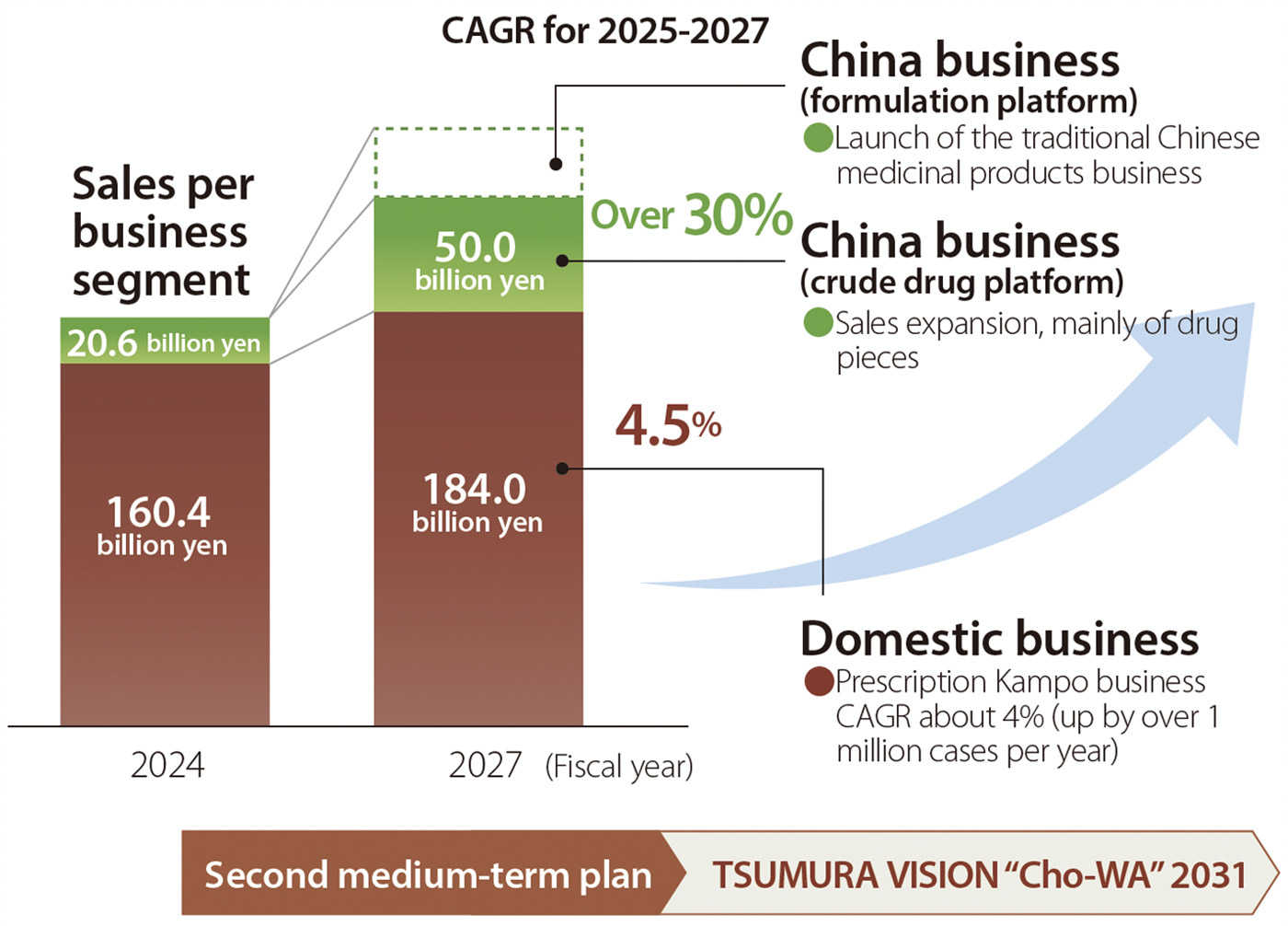

Accelerate Initiatives to Achieve 8% ROE as Quickly as Possible

The Tsumura Group is very strong in terms of business and finances, and has sufficient elbow room for investment. Nevertheless, to increase profit margins for each business, I think the Company must take another step up in terms of cost structure. To that end, and to realize our long-term management vision, we are working to raise employee awareness and commitment to higher return on investment and labor productivity, using the ROIC tree as a tool. At the same time, we have to follow through on our initiative for topline expansion. It’s a given that we need this to be steady. Accumulating the results of various initiatives, including inorganic ones, we will maintain the pace of annual growth in the domestic prescription drug market by 1 million cases, increase sales of OTC drugs and healthcare products, and realize average annual growth of over 30%, focused on drug piece sales in China via our crude drug platform.

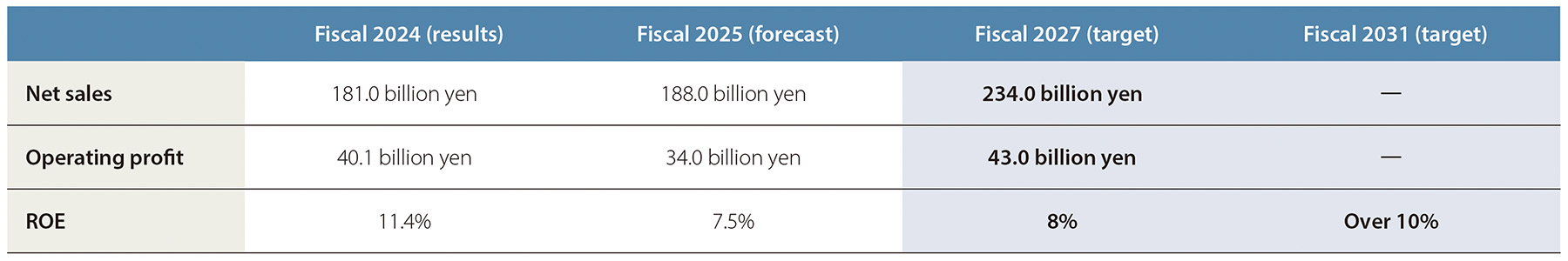

Over the course of our second medium-term management plan, we will put high priority on the strategic investment program we began during the last plan. Although we are entering a phase in which ROE will fall temporarily, we must execute the entire capital investment plan for the coming three years. We cannot ignore rising construction costs in recent years, but we must address the aging of our plants and equipment and build systems for reliable supply, capable of flexibly handling future sales growth as well as any sudden surge in demand, as happened during the pandemic. These are essential management challenges we must take on immediately. Our investment levels will spike during this plan, but I see this as reinforcing our footing for major growth of the Group over the coming three years and onward.

Our ROE is above 7%, exceeding the current cost of shareholders’ equity, but below the equity market expectation of 8%. I understand this makes it hard for us to garner positive understanding from investors. So I’m not convinced all will be well if we continue as planned. To bring ROE up to 8% as quickly as possible, we will first conduct a thorough review of our investments and expenses, and continue relentlessly pursuing efficiency. We will also actively undertake initiatives for inorganic growth, taking a multifaceted approach, and by undertaking them ahead of the plan, we may soon start seeing our fiscal 2031 targets, 20% operating profit margin and 10% ROE, coming within reach—and we may do far better.

Business Scale Expansion

Second Medium-Term Management Plan Numeric Targets

Reinforcement of the Balance Sheet and Dividend Policy with Unchanged DOE Value

With an equity ratio over 60%, the Tsumura Group has plenty of financial leeway. This comes from the profits we’ve built up over the years, giving us a very high credit rating. Since the previous medium-term management plan, we have been implementing management methods focused on the balancesheet from a medium- to long-term perspective, as well as measures to increase capital efficiency. We’ve already seen positive results from the initiative, such as reducing cash on hand and selling cross-shareholdings. We’ve also reduced our cash conversion cycle by about half a month by cutting our payment term for accounts receivable.

Through our second medium-term management plan, we will further reinforce our management systems focused on the balance sheet. We plan to further reduce our cash conversion cycle, excepting inventories under our business continuity plan (BCP), by about three months by applying creative inventory management methods using digital transformation (DX) technology. We plan to achieve zero cross-shareholdings in principle during the current medium-term management plan, as laid out in our published policy, and are continuing discussions with our partners to get it done as soon as possible. By further optimizing cash on hand, we will increase investment. To meet any shortfall in investment funds, we plan to use financial leverage more than before, making the most of interest-bearing debt.

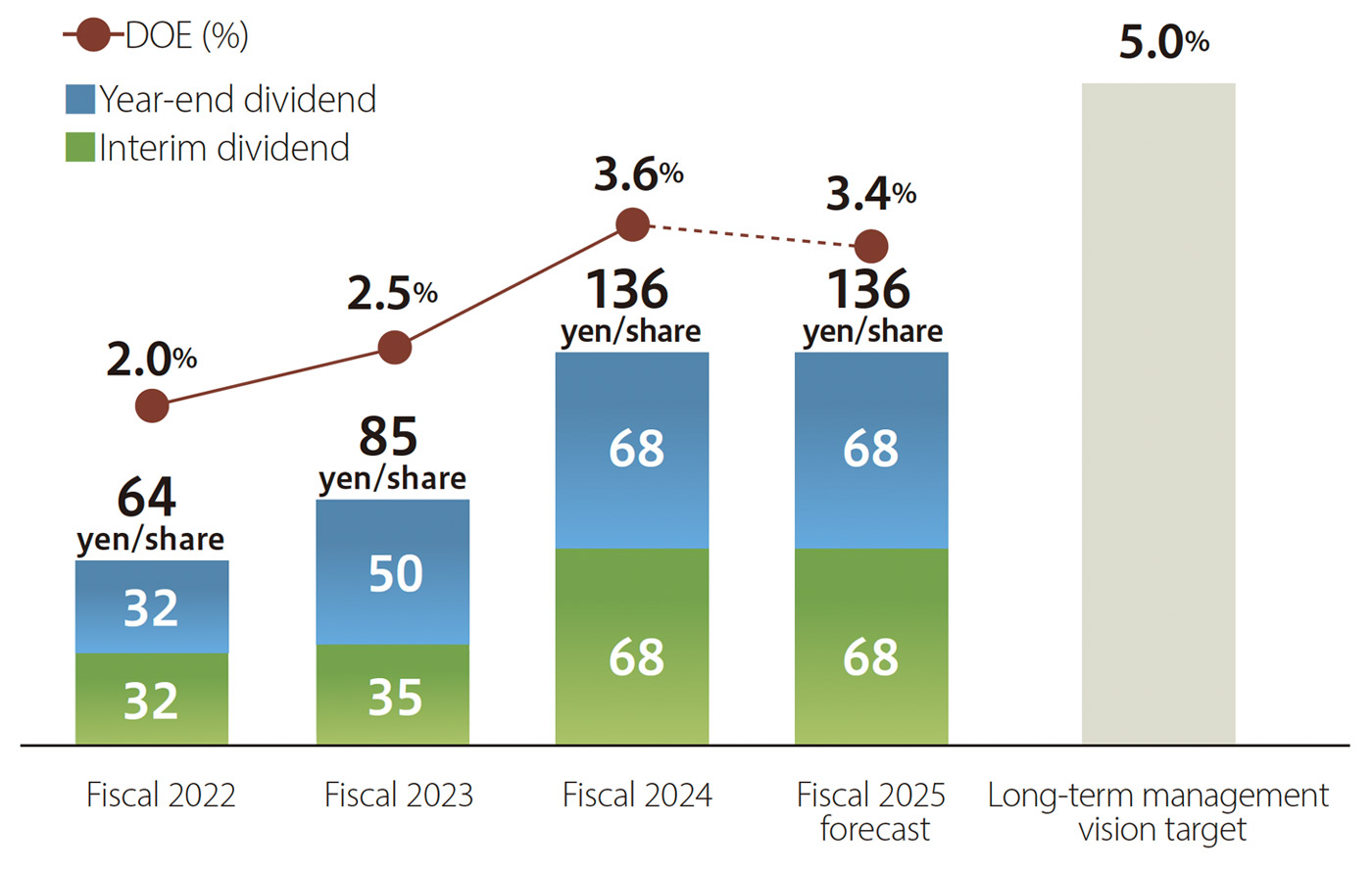

In fiscal 2025, we project lower profit than last year because overall costs and SG&A expenses increased beyond sales growth as we stepped up BCP inventories and hired production personnel in advance, adding personnel costs. Despite the drop in profit, we decided to maintain the same dividend for two reasons: minimize shrinkage of our dividend on equity ratio (DOE) and avoid passing on the burden of strategic investment to shareholders. Our DOE-centered dividend policy will not change. Thinking of 3.4% as the floor of our projected DOE for fiscal 2025, we are working to ensure profit growth to achieve our 5% target for fiscal 2031. Through dialogue with shareholders and investors, I intend to refine this policy for increasing corporate value.

Shareholder Return Policy

Shareholder returns are an important part of Tsumura policy. For us, setting this rate involves consideration of medium- to long-term profit projections, cash flow, and balance sheet management, as we work to build corporate value based on continuous growth of domestic business and growth-oriented investment in operations in China, where we are building new foundations. We will increase our dividend toward 5% DOE, our target for fiscal 2031.