CFO Message

Kampo Value Chain Built over the Years Is Our Basis for Sustainable Profit

In the Kampo market drug prescriptions will change along with changing healthcare needs over time, but none of the 129 Tsumura prescription Kampo formulations on Japan’s National Health Insurance drug price list will become obsolete. In our business we can confidently project sustainable profits over the long term as we respond to structural changes in society, such as our aging population and the expanding roles of women, and related disorders.

The Tsumura Group controls the quality of natural drug ingredients, from the cultivation of medicinal plants on up, and has the technologies and expertise to enhance the safety, efficacy and consistency of our pharmaceuticals. We have succeeded in securing unique intangible assets on the strength of the original Kampo value chain we’ve built over many years, encompassing the production and procurement of the medicinal plants that provide the ingredients for our crude drug products, manufacturing and sales.

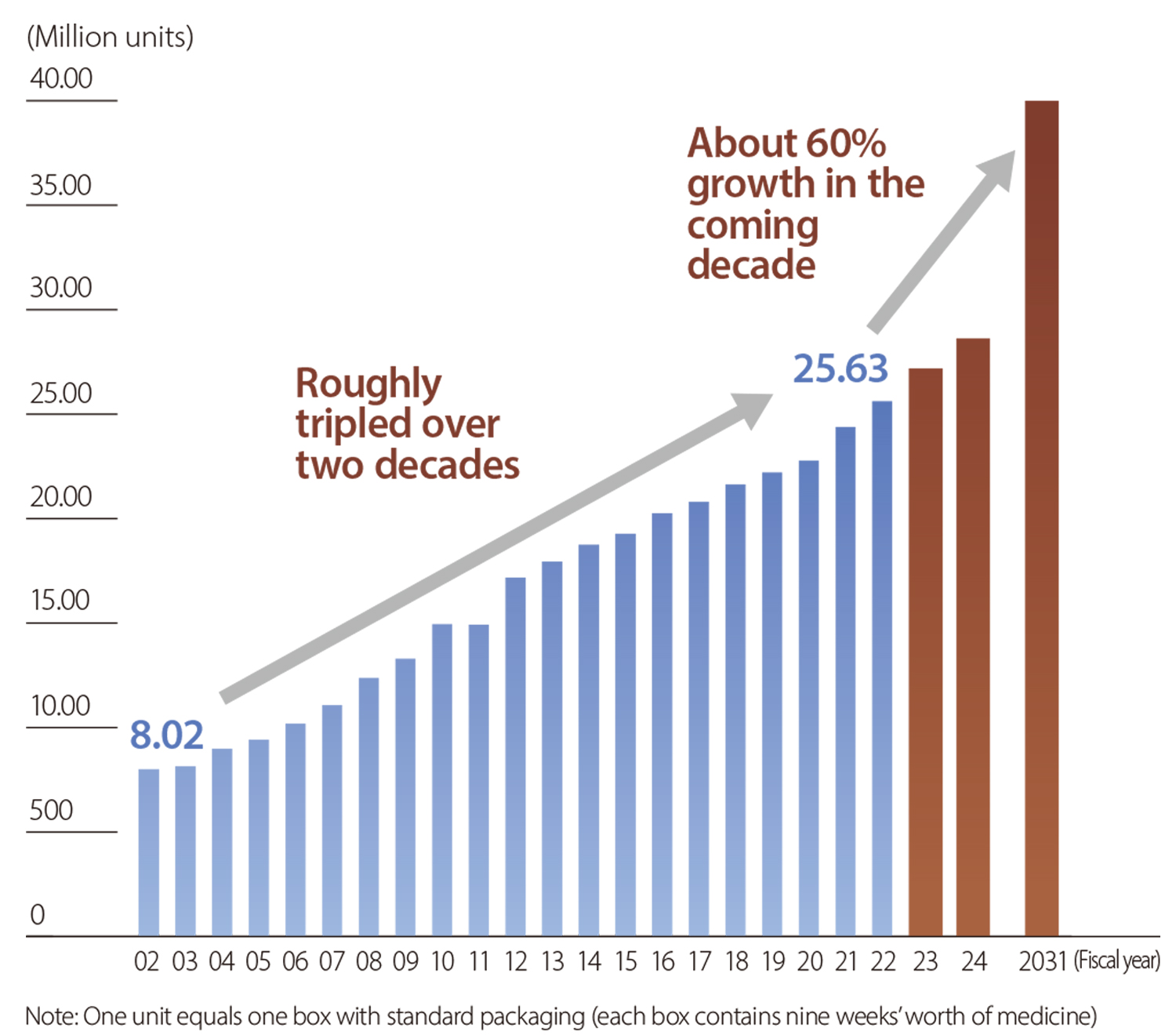

Sales volume of our prescription Kampo formulations has roughly tripled over the past two decades. Affected by reductions of National Health Insurance (NHI) drug prices, however, that growth in volume has not translated into increasing sales value. To increase profitability I think it’s important to better control costs through higher productivity and other measures while expanding production capacity to match the steady sales growth.

Our domestic Kampo business is structurally vulnerable to exchange rate fluctuations because we procure many raw material crude drugs from China. We hedge exchange risk using forward exchange contracts, but that’s not a fundamental solution. Over the long term we are working to expand sales by our Chinese operation to meet those of our domestic operation, hoping to create a structural risk hedge as well. In the government drug price revision of April 2023, 40 Tsumura Group products were made eligible for price re-evaluation as money-losing products affected by a surge in raw material costs. As a result, our weighted NHI price revision rate for our 129 prescriptions netted a positive 2.3%.

Net sales volume for 129 prescription Kampo formulations

Invest with a Sense of Urgency to Securely Seize Growth Opportunities

Our domestic prescription Kampo formulation business has been reliably showing annual growth of 2-3%, but we can see greater growth opportunities now. With our first medium-term management plan (FY2022-2024) we are planning for annual growth of 5%, and working to enhance production equipment accordingly. We have a plan to expand our newest plant, in Tianjin, to a third phase to increase its capacity to produce powdered extracts of Kampo drugs for our domestic operation by over 30%.

Investment scale will be particularly large over the three years of the first medium-term management plan, including the new lines for granulation and packaging. We will execute this plan with a sense of urgency to seize growth opportunities.

Under our long-term management vision, on the other hand, we are working to raise our proportion of overseas sales to over 50% of total sales by growing Chinese sales to meet domestic sales levels. In our crude drug platform, as a leader in the industry’s development we are working to hold the largest share of the crude drug and drug piece market in China, and continuing to enhance our Yakushokudogen product line. The first medium-term management plan also calls for a compound annual growth rate above 30%, with external sales greater than 50%. With our formulation platform we operate by making the most of our expertise in quality management, evidence-building for prescription efficacy, and production technology to establish our brand as a leading manufacturer of traditional Chinese medicinal products. Also as part of the first medium-term management plan, we are reinforcing our business foundation by targeting classical prescriptions.

Correctly Communicate the Essential Value of the Tsumura Group to Stakeholders

Our medium- to long-term challenge is to enhance cash-flowfocused management by improving CCC*. As an example of embracing this challenge, we have begun building a system to realize strategic, optimal crude drug inventory control for the entire Group.

To build productivity we are using AI, robotics and similar technologies and implementing Kampo value chain reform in various areas, from production processes to automated sorting of crude drugs.

Concerning cash allocation, we plan to procure funds as interest-bearing liabilities as well as generate cash flow through regular business operations. Growth investment to facilitate the expansion of production capacity and build new systems will be essential to realizing our longterm management vision. In balancing this with returns to shareholders, I am aware of issues in upcoming business development stages that have been on the agenda of our Board of Directors.

With our price-to-book value ratio below 1, we regret that we are not measuring up to the expectations of our shareholders. At the same time, we are working to better communicate with shareholders to clarify understanding of unclear factors, including the effects of NHI drug prices on our domestic operation and strategy for the Chinese operation, reflecting our responses to turns of events, as well as the value of our pre-financial capital, which we have not spoken of enough.

I think my job as CFO is to draw a road map to higher corporate value over the medium to long term based on growth strategy. Another, as I understand it, is to correctly inform our stakeholders about the essential value of the Tsumura Group through active investor relations. I will continue to furnish clear evidence of the growth the Group is making.

- Cash conversion cycle. A financial indicator that shows the number of days between accountspayable payments and the collection of trade receivables.